Max 403b Employee Contribution 2024

Max 403b Employee Contribution 2024. This type of plan is. This means that for savers under 50, you can defer $23,000 per year, or a total.

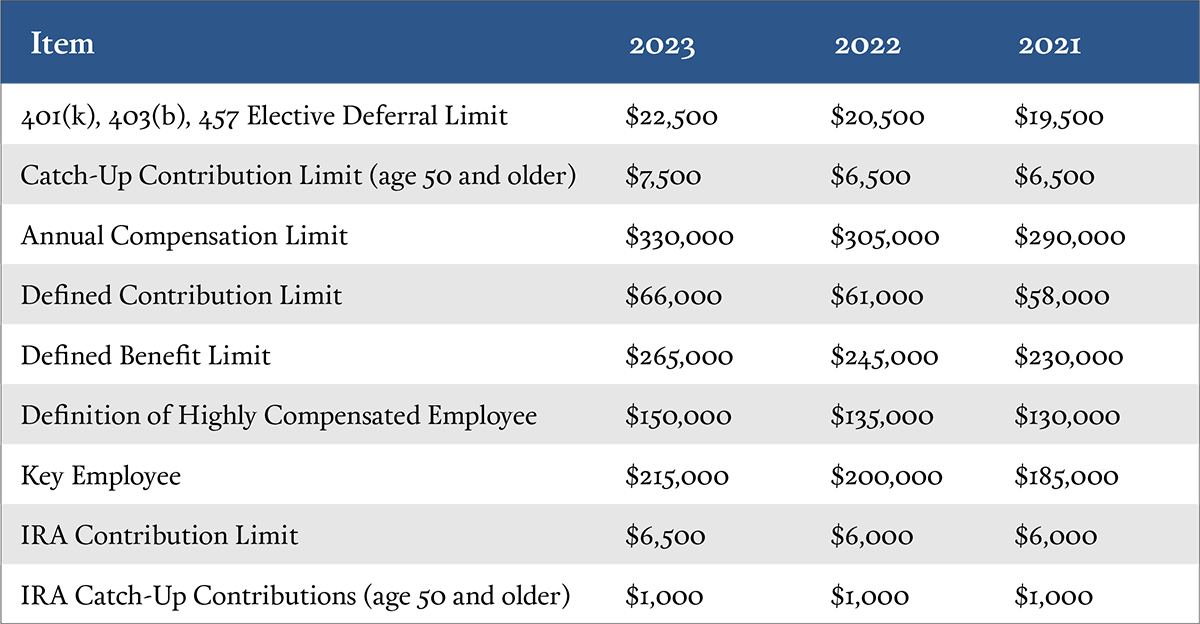

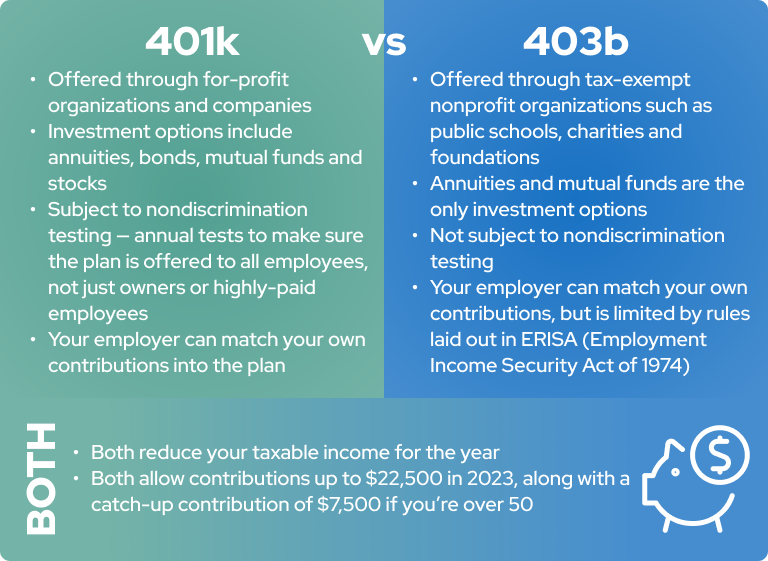

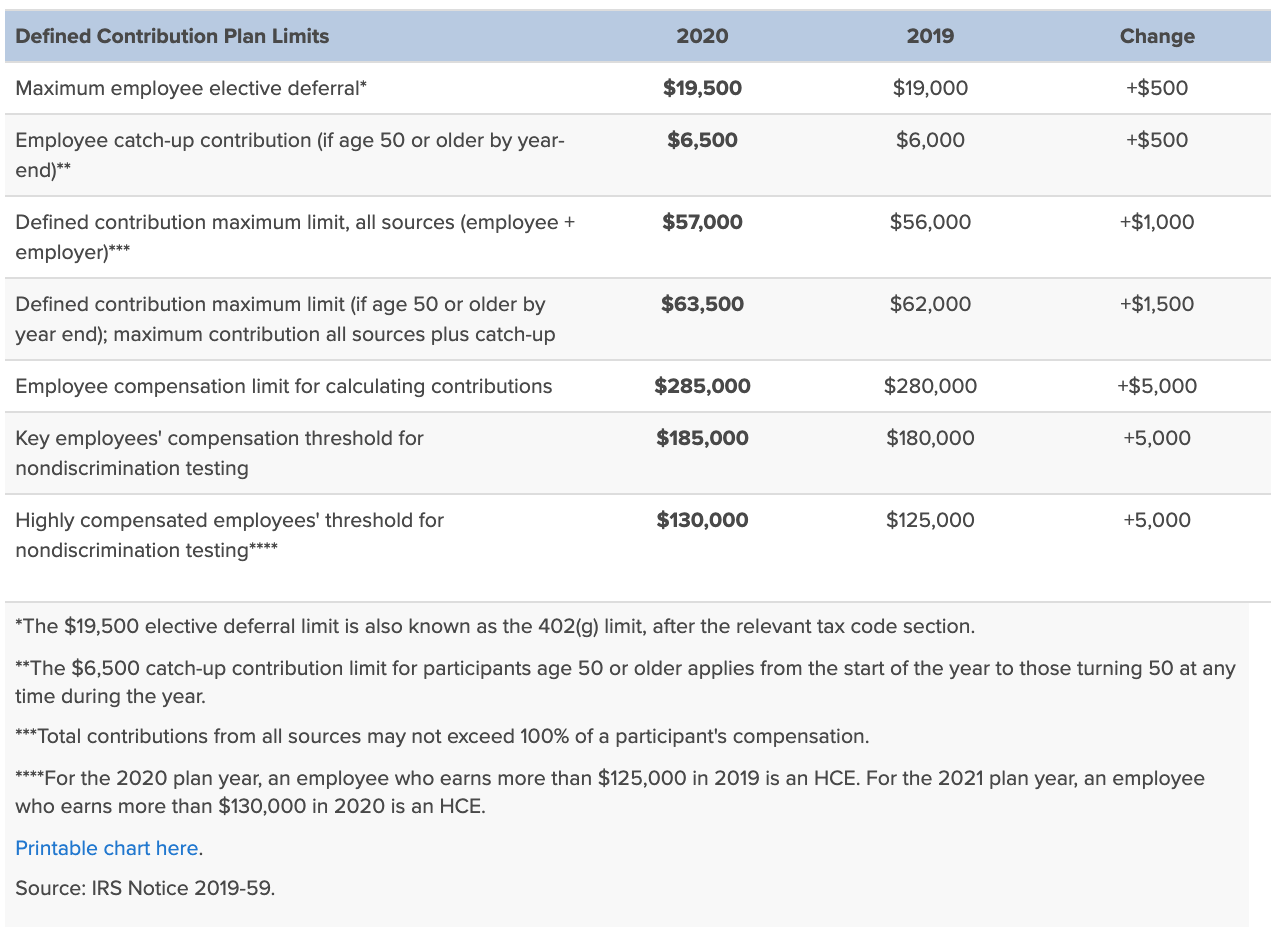

The maximum amount an employee can contribute to a 403 (b) retirement plan for 2024 is $23,000, up $500 from 2023. The 401k/403b/457/tsp contribution limit is $22,500 in 2023.

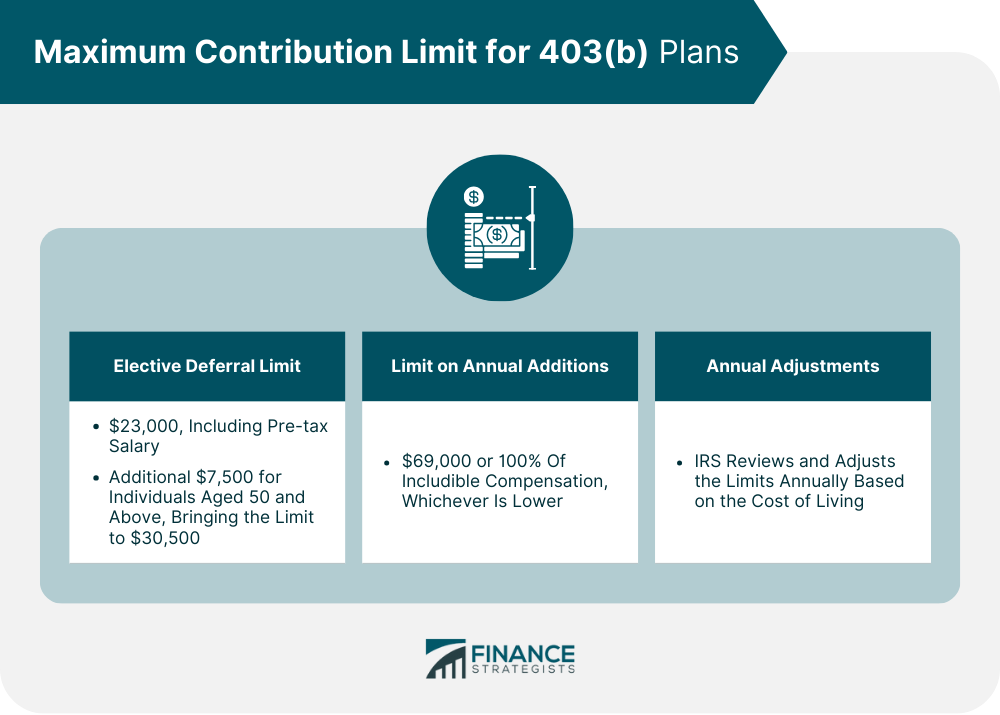

The 403B Contribution Limits For 2024 Are:

If you're 50 or older, you can contribute an.

For 2024, The Limit On Annual Additions Has Increased From $66,000 To $69,000.

The maximum amount an employee can contribute to a 403 (b) retirement plan for 2024 is $23,000, up $500 from 2023.

For 2023, The 403 (B) Max Contribution Limit Is $22,500 For Pretax And Roth Ira Contributions.

Images References :

Source: www.usatoday.com

Source: www.usatoday.com

403(b) Contribution Limits for 2024, This is the limit across all 403 (b). The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to.

Source: choosegoldira.com

Source: choosegoldira.com

maximum employer contribution to 401k 2022 Choosing Your Gold IRA, 2024 403 (b) contribution limits. This type of plan is.

Source: www.financestrategists.com

Source: www.financestrategists.com

Maximum 403(b) Contribution Limits, Factors, and Strategies, The 2024 403(b) contribution limit is $23,000 for pretax and roth employee contributions, and $69,0000 for employer and employee contributions. The maximum amount an employee can contribute to a 403 (b) retirement plan for 2024 is $23,000, up $500 from 2023.

Source: www.financestrategists.com

Source: www.financestrategists.com

Maximum 403(b) Contribution Limits, Factors, and Strategies, The 401k/403b/457/tsp contribution limit is $22,500 in 2023. The contribution limit for 403 (b) plans is $23,000 in 2024 for workers under age 50, up $500 from $22,500 in 2023.

Source: aegisretire.com

Source: aegisretire.com

New IRS Indexed Limits for 2023 Aegis Retirement Aegis Retirement, This is the limit across all 403 (b). The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to.

Source: www.retireguide.com

Source: www.retireguide.com

403(b) Retirement Plans TaxSheltered Annuity Plans, The total employee contribution limit to all 401 (k) and 403 (b) plans for those under 50 will be going up from $22,500 in 2023 to. This means that for savers under 50, you can defer $23,000 per year, or a total.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, $69,000 in 2024 ($66,000 for 2023; The 403b contribution limits for 2024 are:

Source: mungfali.com

Source: mungfali.com

Solo 401k Contribution Limits For 2020 & 2021 41C, 457 plans, thrift savings plan 2024. If you're 50 or older, you can contribute an.

Source: merrychristmasandhappy2023.pages.dev

Source: merrychristmasandhappy2023.pages.dev

401k Contribution Limits 2023 Get New Year 2023 Update, For distributions made after december 31, 2023, an. The 403b contribution limits for 2024 are:

Source: www.slideserve.com

Source: www.slideserve.com

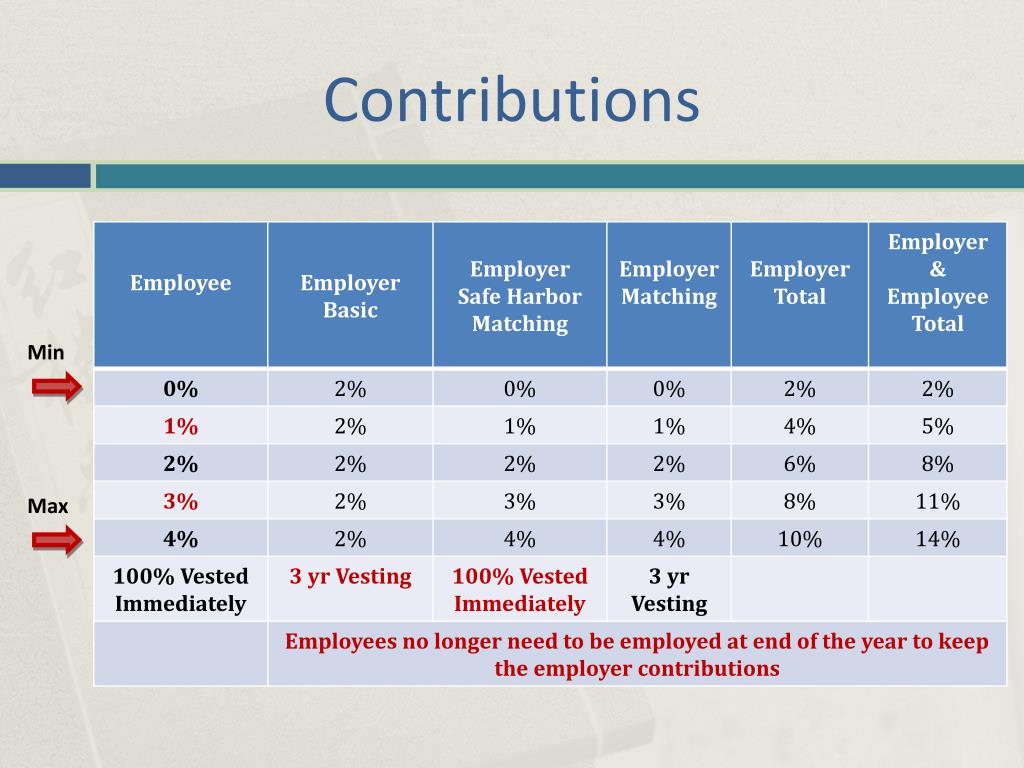

PPT NSU 403(b) Plan Conversion To Safe Harbor 401(k) Plan PowerPoint, If you're 50 or older, you can contribute an. Starting in 2024, employees can contribute up to $23,000 into their 401 (k), 403 (b), most 457 plans or the thrift savings plan for federal employees, the irs.

$69,000 In 2024 ($66,000 For 2023;

If you are under age 50, the annual contribution limit is.

401 (K) Contribution Limits For 2024.

The maximum 403 (b) contribution refers to the highest amount that an individual can contribute to their 403 (b) retirement plan in a given tax year.